Estate Freeze Techniques

GRATs, Installment Sales to Grantor Trusts, Preferred Partnerships and Other Estate Freeze Techniques: A Comprehensive Guide for High Net Worth Families

Transferring wealth to heirs during life offers many tax advantages over waiting until death, generally resulting in lower transfer taxes. However, high net worth individuals face a complex set of non-tax challenges in transferring wealth to future generations during their lifetime. Many people are reluctant to relinquish control over their assets before death, and many individuals want to continue to receive the income from their assets during their lifetime. Estate freeze strategies like GRATs, Preferred Partnerships (or “Freeze Partnerships”), and installment sales to grantor trusts allow high net worth individuals to obtain the benefits of reduced transfer taxes associated with lifetime gifts while permitting the donor to retain some control over the assets and associated income streams.

The Rundown

Shifting wealth to younger generations during your lifetime can yield significant tax savings, but the complex rules in Chapter 14 of the tax code pose challenges for high-net-worth individuals seeking to maintain control and cash flow while transferring appreciating assets.

Preferred Partnership freeze techniques offer a powerful solution by allowing you to retain a preferred interest with a steady income stream, while gifting the appreciation and economic upside to your heirs in a tax-advantaged manner.

With proper planning and execution, Preferred Partnerships let you have your cake and eat it too - but careful structuring is essential to avoid some potentially very punitive tax consequences.

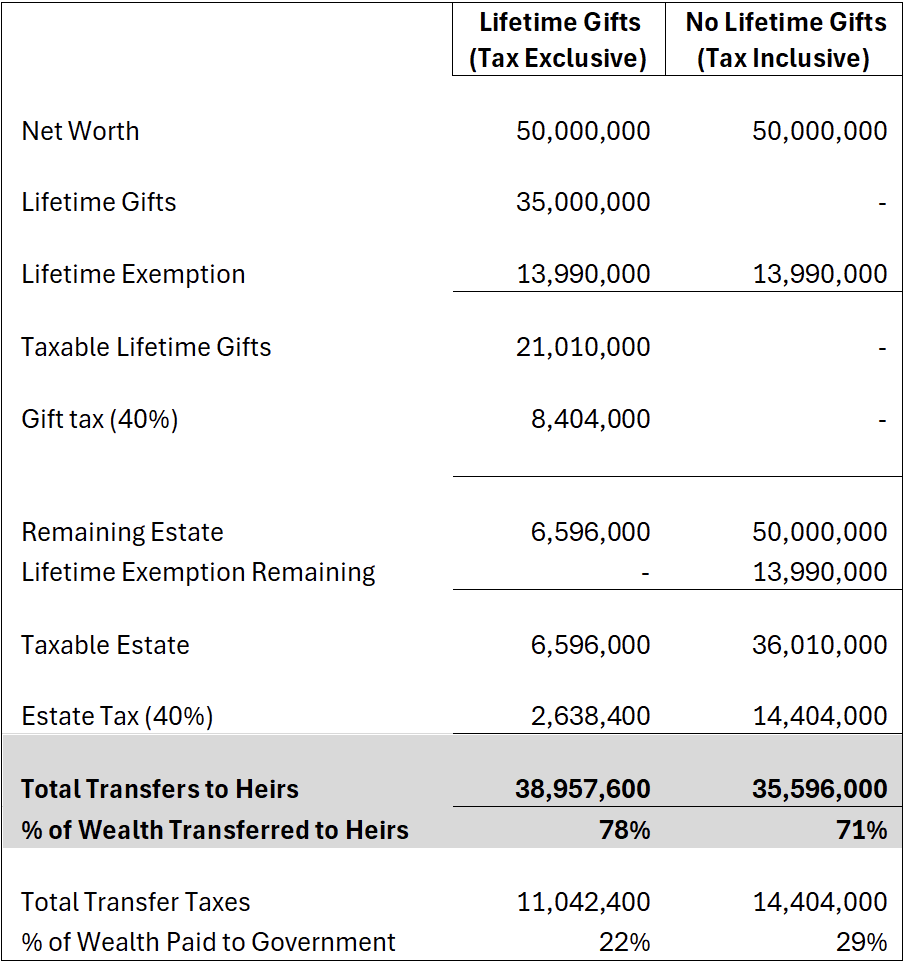

Lifetime Gifts vs. Transfers at Death

Gifting appreciating assets earlier results in a lower taxable transfer, and more tax-efficient strategies like valuation discounts are more generally available for lifetime transfers. Moreover, the gift tax is "tax-exclusive," meaning it's paid separately from the gifted amount, while the estate tax is "tax-inclusive," paid from the estate itself. As a result, lifetime gifts have a lower effective tax rate than transfers at death, resulting in a larger share of wealth passing to beneficiaries. Here is an illustrative example, assuming a net worth (estate) of $50 million and a lifetime exemption of $13.99 million, as in effect in 2025:

As you can see in this example, by making lifetime gifts rather than waiting until death, significantly more wealth can pass to their heirs, with a lesser share paid in gift and estate taxes. In the case above, the donor transferred 70% of their net worth during their lifetime, which resulted in a ~23% decrease in gift and estate tax liability.

Internal Revenue Code Section 2036 and Chapter 14 create both obstacles and planning opportunities so that high net worth individuals can make lifetime transfers to their heirs to take advantage of the more tax efficient lifetime transfer strategies, while retaining some degree of control over their assets and their associated income interests. The three primary planning strategies are GRATs, preferred partnerships, and installment sales to grantor trusts. Understanding these strategies is essential for anyone contemplating transfers of their investment and business assets or establishing family succession plans. Successfully navigating these rules can result in highly tax-efficient wealth transfers, especially when combined with other estate planning strategies, like valuation discounts.

As you can see in this example, by making lifetime gifts rather than waiting until death, significantly more wealth can pass to their heirs, with a lesser share paid in gift and estate taxes. In the case above, the donor transferred 70% of their net worth during their lifetime, which resulted in a ~23% decrease in gift and estate tax liability.

Internal Revenue Code Section 2036 and Chapter 14 create both obstacles and planning opportunities so that high net worth individuals can make lifetime transfers to their heirs to take advantage of the more tax efficient lifetime transfer strategies, while retaining some degree of control over their assets and their associated income interests. The three primary planning strategies are GRATs, preferred partnerships, and installment sales to grantor trusts. Understanding these strategies is essential for anyone contemplating transfers of their investment and business assets or establishing family succession plans. Successfully navigating these rules can result in highly tax-efficient wealth transfers, especially when combined with other estate planning strategies, like valuation discounts.

The Evolution and Impact of Chapter 14

Congress introduced Chapter 14 to address what it perceived as abusive estate freeze techniques, which allowed wealthy families to transfer value to younger generations with minimal tax consequences. These rules apply broadly, even when tax savings isn't the primary objective, affecting corporations, partnerships, trusts, investments, and various business arrangements.

Corporate and Partnership Transfers

Section 2701 imposes special valuation rules on family transfers of corporate and partnership interests when the transferor retains an "Applicable Retained Interest" — an equity interest with either "extraordinary payment rights" (liquidation, put, call, or conversion rights) or distribution rights in a class different from or senior to the transferred interest.

For example, when a parent recapitalizes a company to give common stock to children while retaining preferred stock (to shift appreciation while keeping current income), Section 2701 typically applies. Unless structured as a "qualified payment right," retained distribution rights are valued at zero, making the entire business value a taxable gift despite the donor's continued ownership interest.

To avoid this outcome, retained distribution rights must qualify as "qualified payment rights" —providing mandatory, cumulative distributions payable at least annually at a fixed rate, with payments due by year-end (subject to a four-year grace period).

Trust Transfers

Section 2702 transformed trust interest valuation for gift tax purposes. Before this law, GRITs allowed potential manipulation when actual trust income fell below the assumed income rate used for gift tax calculations.

The "zero valuation" rule eliminated this by assigning zero value to retained interests unless they qualify as "qualified interests." This effectively ended traditional GRITs for family transfers while establishing the framework for GRATs, which feature precisely defined, quantifiable annuity payments that are less susceptible to manipulation.

By requiring fixed payments regardless of trust performance, GRATs provide greater certainty for both grantors and tax authorities, reflecting Congress's approach of addressing perceived abuses while preserving similar planning opportunities with increased transparency.

GRATs Tax-Efficient Appreciation Transfer

While GRATs typically aren’t as tax efficient as the installment sale and preferred partnership strategies discussed later, GRATs do have some appealing use cases. Like the other two strategies, the elegance of a GRAT lies in its capacity to channel appreciation beyond a statutory threshold to beneficiaries free from gift taxation. However, unlike the other two strategies, GRATs do so using a defined legal statute.

GRATs can be strategically structured as "zeroed-out" arrangements, resulting in nominal taxable gifts upon creation. This approach is particularly valuable when the transferor has limited gift tax exemption available or wishes to minimize immediate gift tax exposure.

When assets held within a zeroed-out GRAT appreciate at rates surpassing the Section 7520 interest rate—often referred to as the "hurdle rate"—and the grantor successfully navigates the specified term, this excess growth flows to the remainder beneficiaries without triggering gift tax consequences.

The Section 7520 interest rate is published monthly by the Internal Revenue Service, which is equal to 120% of the Applicable Federal Rate (AFR). The AFR is typically calculated by the IRS based on the prevailing yield on Treasury securities with maturities ranging from three to nine years. Accordingly, the Section 7520 rate is approximately 20% greater than an intermediate-term Treasury.

In essence, the structure creates a bifurcation of asset growth: the grantor maintains both the principal value and any appreciation up to the Section 7520 threshold, while any value appreciation exceeding this rate inures to the beneficiaries. This mechanism harnesses the transferred assets’ outperformance over the 7520 rate to facilitate tax-advantaged wealth transfers.

GRATs benefit from specific regulatory provisions that allow for valuation adjustments. If the IRS reassesses the value of contributed assets upward, the annuity payment can be recalculated to maintain the originally intended gift amount, providing a valuable safeguard.

However, GRATs have some significant shortcomings compared to the other two strategies. In addition to having to use the higher Section 7520 rate for the hurdle rate (as opposed to the AFR used by the other strategies), and the difficulty substantiating higher valuation discounts due to the higher annual annuity payments required for GRATs, the tax rules for GRATs require them to be effectively unwound if the grantor dies during the GRAT term.

To attenuate this risk, short-term "rolling" GRATs can be deployed to reduce mortality risk and also strategically capture periods of accelerated asset appreciation. However, there is scant guidance on how long the term of a GRAT must be to qualify for the favorable tax treatment. Most practitioners believe that a two-year term is sufficient, and anything less runs the risk of IRS challenge.

As discussed below, GRATs however are not advisable when the intent is to transfer assets to multiple generations of heirs. In this case, either the preferred partnership or installment sale to grantor trust strategies are greatly preferred.

Preferred Partnership Estate Freezing Mechanism

A preferred "freeze" partnership constrains the future growth of a senior family member's preferred interest to a predetermined rate of return and liquidation preference. This structure allows future appreciation to accrue primarily to common interests held by younger generations, creating a tax-efficient wealth transfer channel. This highly customizable strategy can achieve more tax-efficient wealth transfers than GRATs and installment sales to grantor trusts. A preferred partnership interest can be combined with either a GRAT or installment sale, along with strategies like valuation discounts and dynasty trusts to enhance tax efficiencies.

Preferred partnerships create distinct economic classes of interests—preferred and common—tailored to accommodate varying needs, objectives, and risk tolerances across family members, facilitating more personalized wealth planning solutions.

IRC Section 2036 requires previously gifted assets to be included in a taxpayer's taxable estate where they retained certain control over those assets after transfer. However, a properly structured and administered preferred partnership allows high net worth individuals to achieve significant transfer tax benefits while maintaining some control over transferred assets and income streams without triggering Section 2036.

A Preferred Partnership begins with either creating a new partnership or recapitalizing an existing one to establish two distinct equity classes: preferred and common interests. The donor (typically the senior family member) receives preferred interests providing two key benefits: a fixed cash flow stream structured as a "qualified payment right" and a liquidation preference. Younger family members or trusts for their benefit receive common interests, which capture all economic upside and appreciation beyond the preferred return.

The success of this strategy depends on properly structuring the preferred interest as a qualified payment right under Section 2701. The qualified payment right must meet these criteria:

(1) The distribution must be either a dividend payable on a periodic basis under cumulative preferred stock at a fixed rate, or any other cumulative distribution payable at least annually at a fixed rate or amount. The rate can be tied to a specified market interest rate.

(2) Payments must be cumulative, meaning unpaid amounts accumulate and must be satisfied before any distributions to common interest holders.

An election can be made on a timely filed gift tax return to treat a distribution right as a qualified payment right. This election assumes a fixed annual payment will be made regardless of cash flow. Payments must be made by the specified date in the governing instrument or, if none is specified, by the last day of the calendar year. A four-year grace period exists for making payments, and obligations can be satisfied with debt instruments bearing compound interest if the term doesn't exceed four years.

The "lower of" rule becomes particularly relevant when the preferred interest includes both a qualified payment right and an extraordinary payment right. In such cases, the equity interest is valued based on whichever right produces the lower value. This creates planning opportunities but requires careful consideration in structuring retained interests.

Using the Preferred Partnership GRAT to Overcome Estate Tax Inclusion

Traditional GRATs face a key limitation when engaging in multigenerational planning – GST tax exemption can only be allocated after the GRAT term terminates. By then, asset appreciation often requires substantially more exemption, increasing transfer tax costs.

The Preferred Partnership GRAT may offer a solution for some use cases. A senior family member creates a preferred partnership, receiving both preferred and common interests, and transfers only the common interests to a GRAT. Since the senior family member retains no interest in the transferred common interests themselves (only in the preferred partnership interests), the ETIP rules may not apply, potentially allowing immediate GST exemption allocation at the common interests' initial, lower value.

This structure combines preferred partnerships' estate freezing benefits with GRATs' gift tax efficiency while circumventing ETIP limitations. Though effective for multigenerational planning with appreciating assets, combining a preferred partnership with an installment sale to a grantor trust may be more tax-efficient, since installment sales use the lower AFR instead of the Section 7520 rate required for GRATs.

Strategic Carried Interest Transfers

Preferred partnerships provide a framework for transferring carried interests in a manner that avoids triggering the zero valuation rule under Section 2701. This offers an alternative to the conventional "vertical slice" approach, potentially creating more favorable tax outcomes.

QTIP Trust Integration

When combined with a Qualified Terminable Interest Property (QTIP) Trust, a Freeze Partnership can deliver a consistent income stream to a surviving spouse while directing future growth to other beneficiaries in a tax-advantaged manner.

Structuring Considerations

When structuring Preferred Partnerships, one must ensure they serve legitimate business purposes beyond tax savings and employ valuation methods based on objective standards that accurately reflect fair market value at formation. The partnership should include mechanisms for periodic review of valuations and ensure terms mirror those found in arm's length transactions. The partnership must not exclude significant assets when determining value and must fully comply with Section 2701's requirements for preferred and common interest structures.

One critical technical requirement often overlooked is the minimum value rule: The value of a junior equity interest cannot be less than its pro rata portion of 10% of the sum of the total value of all equity interests, and the total amount of indebtedness owed to the transferor and Applicable Family Members (generally family members that are in the same generation as, or a higher generation than the transferor). This minimum value rule can limit the effectiveness of planning techniques that attempt to significantly reduce the value of the transferred interests.

Even if the preferred interest is structured to avoid the zero valuation rule, the IRS can still challenge the valuation of the preferred coupon. If the coupon rate is less than what would be required in anarm's-length transaction, the IRS may argue that a gift has still been made, and if the IRS can prove the coupon rate is too low, it can still claim that there is a taxable gift. However, if the coupon rate is properly structured to reflect an arm's-length transaction, the IRS will not be successful in this type of argument. Determining the appropriate coupon rate for a preferred partnership requires engaging a qualified appraiser to prepare a valuation appraisal. This ensures the senior family member receives value equal to par for their capital contribution. The appraiser will typically consider factors outlined in IRS Revenue Ruling 83-120.

The partnership must avoid recharacterization of the preferred interest as debt by considering factors such as management participation, voting rights, subordination to creditors, adequate capitalization, overlap between preferred and non-preferred interest holders, partnership creditworthiness, and the documented intent of the parties.

To address potential Section 2036 retained control issues, senior family members should typically hold nonvoting limited partnership interests rather than general partner or voting interests. Despite otherwise meeting the requirements discussed above, in cases involving Preferred Partnerships, the IRS has argued for the gifted assets to be included in the donor's taxable estate under Section 2036(a)(1) to the extent that the donor also acts as the managing or general partner of the Preferred Partnership and retains control over, or the power to designate who may enjoy, the property of the Preferred Partnership. The IRS may be successful if the senior family member has too much control or power over the partnership.

Income Tax Considerations

The income tax implications deserve careful attention. Structuring the preferred coupon requires navigation of both disguised sale rules and guaranteed payment rules. A disguised sale may occur when a partner contributes property to a partnership and receives a distribution that is essentially a return of their contributed capital. The IRS may try to argue that a distribution is part of a disguised sale if the distribution would not have been made but for the contribution of property to the partnership, and the distribution is not dependent on the entrepreneurial risks of the partnership.

However, Treas. Reg. Section 1.707-4(a)(3)(ii) provides a safe harbor exception for preferred returns where payments to the contributing member are "reasonable" and the facts do not "clearly establish" that the distribution is part of a sale. Under these rules, a preferred payment is considered "reasonable" if it does not exceed the contributing partner's unreturned capital at the beginning of the year, multiplied by 150% of the highest applicable federal rate (AFR).

Example: If a partner contributes $1,000,000 to a partnership, and the highest applicable federal rate is 5%, the safe harbor for a reasonable preferred return would be 150% * 5% * $1,000,000 = $75,000. Thus, if the partnership pays the partner a preferred return of less than or equal to $75,000, it is presumed to be a reasonable return and not part of a disguised sale. If the preferred return exceeds this safe harbor amount, it does not automatically mean the payment is part of a disguised sale, but it loses the protection of the safe harbor and would require further analysis.

An alternative safe harbor applies to operating cash flow distributions. These distributions are not presumed to be disguised sales unless the facts and circumstances clearly indicate otherwise. An operating cash flow distribution is a transfer of money by a partnership to a partner that does not exceed the partnership's net cash flow from operations multiplied by the lesser of (i) the partner's percentage interest in partnership profits for the tax year in question, or (ii) the partner's percentage interest in overall partnership profits for the life of the partnership.

Meeting the safe harbor requirements under the disguised sale rules might still result in violating the Section 2701 valuation rules, which can interact in complex ways. For example, if a preferred coupon is structured to comply with the disguised sale safe harbor (150% of the AFR), it may not satisfy the requirements of a qualified payment right under Section 2701, which requires the payment to be made annually. In this case, the transferor might intentionally structure the preferred coupon so that it does not meet the requirements of a qualified payment right and then elect to treat it as a qualified payment right on a timely filed gift tax return.

Documentation and Compliance

Proper documentation is crucial for these arrangements. This includes maintaining detailed records of all valuations, elections, and payment histories. Late payments require particular attention - if a payment is more than four years late, the recipient can elect to treat it as a taxable gift. Elections regarding qualified payment rights must be made on timely filed gift tax returns with comprehensive information about the transaction. As with all gift tax returns, it's essential to meet the adequate disclosure requirements to ensure that the protections afforded by the running of the statute of limitations are obtained.

Just like a Family Limited Partnership, it is advisable to adhere to the ongoing administration of the entity just as unrelated business partners would. For Preferred Partnerships, best practices in administration include:

Making sure that the preferred coupon is paid to the Senior Family Member on time, as scheduled, and if a payment is late, the Senior Family Member should take steps to ensure the payment is made.

Ensure the preferred coupon does not match anticipated partnership annual income (Recall that Section 2701 does permit a four-year deferral for a qualified payment right preferred coupon payment and a preferred payment can be satisfied through the issuance of a promissory note with a term no longer than four years.)

The IRS has tried to use economic substance arguments, Section 2703, and Section 2704, as well as substance over form arguments to challenge the valuation of Preferred Partnerships, but taxpayers have been successful when they have been able to demonstrate economic substance, valid business purposes, and compliance with the law.

Why the Installment Sale to IDGTs Are a Powerful Estate Planning Strategy

The installment sale to an IDGT typically results in significantly more tax-efficient wealth transfers than a GRAT due to its lower interest rate requirements, greater availability of valuation discounts, more favorable planning capabilities involving multiple generations of beneficiaries, and superior treatment upon the donor’s death.

An installment sale to a grantor trust involves a transaction with a trust that qualifies as a grantor trust. Such trusts (referred to as IDGTs) attribute income, deductions, and tax credits to the grantor, rendering the trust nonexistent for income tax purposes. This structure creates a key advantage – since the grantor and trust are considered identical taxpayers for income tax purposes, no gain or loss is recognized when the grantor sells assets to the trust, even appreciated property. Similarly, interest payments on the note generate no taxable income to the grantor. The trust typically pays for the asset(s) with a small down payment (typically around 10% of the discounted fair market value) and a note bearing interest at the IRS prescribed Applicable Federal Rate (AFR).

For clients with mortality concerns, IDGTs offer significant advantages. Unlike a GRAT, which is effectively unwound if the donor dies during the GRAT term, assets exchanged in a properly structured sale to an IDGT generally remain outside the donor’s estate even if they die before the note is fully satisfied.

Installment sales to IDGTs excel in multi-generational planning. Unlike GRATs with their Estate Tax Inclusion Period (ETIP) restrictions, IDGTs permit immediate GST exemption allocation, creating superior vehicles for transfers to grandchildren and trusts intended to support future generations of heirs beyond the donor’s children (commonly referred to as dynasty trusts).

Installment sales to IDGTs also provide superior payment flexibility. Interest-only notes with balloon payments maximize trust growth by keeping principal invested longer, creating more efficient wealth transfer than GRATs, which require larger annuity payments that progressively deplete trust assets.

IDGT installment sales are typically more attractive since they use the AFR rather than the higher Section 7520 rate (which is 120% of the AFR) required for GRATs. This difference can significantly impact long-term wealth transfer outcomes.

The ability to transfer assets at depressed values using valuation discounts (you can read more on this strategy here) presents another compelling consideration. The timing of any liquidation of nonmarketable assets (such as FLP interests or closely held business interests) may affect their gift tax valuation. With GRATs requiring substantial annual distributions to the grantor, sustaining significant valuation discounts becomes more challenging if the partnership makes regular distributions to the trust specifically to fund annuity payments. On the other hand, installment payments are typically smaller than GRAT annuity payments since they are based on the AFR rather than the Section 7520 rate, and the note can be an interest only note with a balloon payment. As a result, it is more likely to support a larger discount than if the same asset were contributed to a GRAT.

Finally, IDGTs offer enhanced planning flexibility through note modifications, prepayment options, and selective forgiveness of payments as circumstances warrant—adaptability features generally unavailable with the more rigid GRAT structure.

The chart to the left depicts three different transfers, with the following assumptions:

Asset Undiscounted Value- $6 million

Term Length- 5 Years

Note Down Payment - 10%

Payments per Year- 1

Taxable Gift- $0

The GRAT (dark blue) and first IDGT Installment Sale (Black) use a 25% valuation discount. The second IDGT Installment Sale (Red) uses a 35% valuation discount. The installment sale terms call for interest only payments during the note’s term and a balloon payment at the end of the 5 year period.

As you can see, even at the same valuation discount, the installment sale is preferred to the GRAT because of the lower hurdle rate. Though we illustrated these strategies using the same, relatively short 5-year term (because the GRAT strategy is unwound if the grantor dies during the term), in practice GRATs are generally structured with shorter terms than IDGT installment sales.

Structuring Installment Sales to IDGTs to Withstand IRS Scrutiny

The legal framework supporting this strategy navigates IRC Sections 2036, 2701 and 2702. IRC Section 2036 which applies at one’s death, requires previously gifted assets to be included in a taxpayer’s taxable estate where they retained certain control over those assets after the transfer. IRC Section 2701 and 2702, which applies at the time of a gift, values certain ownership interests retained by a donor to be valued at zero, potentially causing the entire transfer to family members to be treated as a gift, even though the donor didn’t transfer the entire asset.

Case law addressing installment sales' gift and estate tax implications remains sparse. However, analogous income tax cases provide guidance. In various cases, the Ninth Circuit repeatedly characterized similar transactions as bona fide sales in exchange for annuities rather than transfers with retained trust interests. However, in Lazarus v. Commissioner the court ruled against the taxpayer, finding that the taxpayer made a transfer with a retained interest rather than a genuine sale. Critical factors included: the trust's immediate conversion of transferred stock into a note with payments precisely matching amounts owed to the grantor, the non-negotiable note representing the only possible payment source, and the absence of standard sale elements such as a down payment, interest on the deferred amount, or payment security.

In the Tax Court case Sharon Karmazin v. Commissioner; No. 2127-03, the IRS contended both sections 2701 and 2702 might apply to installment sales because the note received in the exchange didn't constitute genuine debt (the case settled on other grounds). The IRS’s position in Karmazin is likely based on the Supreme Court’s ruling in Fidelity-Phila. Tr. Co. v. Smith. In that case, the court held that property transferred for lifetime periodic payments avoids estate inclusion if the payments satisfy the following conditions: (1) represent a personal obligation of the buyer, (2) aren't chargeable to the transferred property, and (3) aren't measured by income from the transferred property.

The IRS confirmed in PLR 9535026 that an installment sale at fair market value wouldn't create a gift, provided that all evidence indicates the note will be paid according to its terms and the trust's payment ability isn't in doubt. The ruling also stated §2701 wouldn't apply because the note wouldn't constitute an "applicable retained interest," and §2702 wouldn't apply because the note would represent debt rather than a term interest. Various other PLRs issued by the IRS come to similar conclusions.

Accordingly, for IRC Sections 2036, 2701, and 2702 purposes, the critical determination is whether the debt is bona fide. With genuine debt, the seller avoids being characterized as retaining an interest in the transferred property, preventing application of these sections. Consequently, proper trust capitalization at inception is vital for ensuring debt payment capability. If a trust can only satisfy the note using the transferred property itself or its returns, this might suggest the seller retained an interest in the property, potentially triggering estate tax inclusion at death or a large gift tax liability at the time of the original transfer. Moreover, administrative failures, such as missed note payments, could suggest the arrangement isn't true debt, potentially resulting in estate inclusion of the sold property at death.

Amplifying Tax Efficiency: Combining Preferred Partnerships with Installment Sales to IDGTs

A powerful strategy to enhance tax efficiency is to combine preferred partnerships with installment sales to IDGTs. This integrated approach leverages the strengths of both techniques to maximize wealth transfer.

When implemented correctly, the preferred partnership strategy establishes two distinct ownership classes in an FLP or closely held business. This dual-class structure enables the common interest to appreciate more rapidly than would be possible with a single ownership class. As demonstrated

in the above analysis, the effectiveness of these wealth transfer strategies increases proportionally with the growth rate of the transferred assets. By creating common interests with enhanced growth potential, this combined approach becomes significantly more powerful.

The process begins with forming a preferred partnership. When the preferred interest is structured as a Qualified Payment Right under Section 2701, it minimizes or eliminates deemed gifts upon creating the different equity classes. The senior family member strategically retains the preferred interest with the highest defensible value, which correspondingly reduces the common interest's value for gift tax purposes using the "Subtraction Method" (where the common interest value equals the total entity value minus the preferred interest value).

The next step involves selling these common interests to an IDGT at fair market value, which avoids triggering gift tax. Applicable valuation discounts for lack of marketability or minority interest further reduce the common interests' value for the sale transaction.

Critically, structuring the preferred interest as a Qualified Payment Right ensures its distribution right maintains value under Section 2701's Subtraction Method. Without this qualification, the preferred interest's value would be zero for gift tax purposes, artificially inflating the gifted common interest's value.

With proper structure and administration, the IDGT-held assets (including future appreciation of the common interests) remain outside the donor's gross estate for estate tax purposes. The donor's estate includes only the installment note received in exchange for the common interests and the preferred interests.

While the preferred interests retained by the parent are included in their estate, their value remains "frozen" at the partnership's creation. All appreciation in the underlying business or assets accrues to the IDGT-owned common interests, effectively bypassing transfer taxes in the parent's estate.

The IDGT's grantor trust status provides additional tax benefits. Since the parent continues paying income taxes on the trust's income, assets within the trust grow tax-free without depleting the beneficiaries' inheritance. Furthermore, the installment sale itself generates no taxable event between the grantor and the grantor trust.

This combined approach offers distinct advantages over alternatives. Unlike GRATs, where the grantor's death during the term causes full estate inclusion, properly structured installment sales to IDGTs generally carry lower estate inclusion risk. Additionally, GRATs' Estate Tax Inclusion Period (ETIP) rules restrict multi-generational tax planning opportunities available with IDGTs and preferred partnerships.

Compared to direct gifts of appreciating assets (which trigger gift tax on the full fair market value), this combined strategy transfers future appreciation with significantly reduced gift tax exposure, creating a more efficient wealth transfer mechanism.

Comparative Effectiveness of GRATs, Preferred Partnerships, and Installment Sales to Grantor Trusts

Growth Horizon Considerations

Long-Term Growth Scenarios: When assets are expected to experience substantial appreciation over extended periods, a preferred partnership or IDGT installment sale may be more suitable for freezing the value of a senior interest while transferring future growth.

Short-Term Appreciation Opportunities: For capturing potentially significant appreciation within a shorter timeframe with minimal upfront gifting, a GRAT or IDGT installment sale often provides a more tactical solution.

Multigenerational Planning

For planning that spans multiple generations and seeks to leverage GST tax exemption effectively, Preferred Partnership or IDGT installment sale structures offer superior results by addressing the ETIP limitations inherent in standard GRATs.

Structural and Compliance Complexity

Preferred Partnerships: These arrangements typically involve more complex structuring to ensure compliance with Section 2701 and to avoid potential reclassification as disguised sales or debt instruments.

GRATs: While operating within a more defined statutory framework under Section 2702, GRATs still require meticulous adherence to regulations, particularly regarding asset valuation.

Installment Sales to IDGTs: These can be more straightforward than a preferred partnership, but require adequate capitalization, formal documentation and strict administration to ensure compliance with Sections 2701 and 2036.

Income Distribution Considerations

Preferred Partnerships: Can be designed to provide predictable income streams to senior family members through the preferred interest.

GRATs: Deliver fixed annuity payments according to predetermined schedules, which may or may not align with the actual income generated by the underlying assets.

Installment Sales to IDGTs: Deliver smaller interest only payments according to the note’s terms, which may or may not align with should not be tied to the actual income generated by the underlying assets.

Mortality Risk Management

GRATs carry inherent greater mortality risks since they are unwound if the grantor dies during the GRAT term, but short-term GRATs and sequential "rolling" GRAT structures can offer specific mechanisms to attenuate this risk factor.

Contextual Effectiveness

There is no universally superior choice between IDGT installment sales, preferred partnerships and GRATs as tax planning strategies. Their relative effectiveness depends on a thorough evaluation of specific circumstances. The strategic combination of a preferred partnership with an IDGT installment sale or GRAT can be particularly advantageous for wealth transfers spanning multiple generations.

The optimal approach—whether utilizing a preferred partnership, an IDGT installment sale, a GRAT, or a hybrid solution—should emerge from comprehensive analysis of your financial position, estate planning objectives, asset characteristics, and anticipated performance. Consultation with experienced estate planning professionals remains essential to developing the most effective strategy for a given situation.

Professional Guidance and Implementation

As the regulatory landscape continues to evolve, staying informed and adaptable in planning approaches becomes increasingly important. Regular review and updates of existing arrangements ensure they remain effective and compliant with current interpretations. When selecting advisors, look for those with extensive experience in family business transfers and estate freeze techniques.

While the rules are complex, they provide opportunities for significant tax savings when properly navigated. The successful execution of estate freeze techniques under Chapter 14 requires balancing immediate tax considerations with long-term family and business objectives. Working with experienced professionals who understand these nuances can help families achieve their wealth transfer objectives while maintaining necessary control and income streams. The goal extends beyond mere technical compliance to creating sustainable structures serving both current and future generations' needs.

A Note On The “Intentionally Defective Freeze Partnership”

Some sophisticated planners have devised what’s referred to as the “Intentionally Defective Freeze Partnership.” This strategy has been used by senior family members who are not otherwise inclined to make taxable gifts during their lifetime but still want to remove appreciating assets from their estate and take advantage of their remaining lifetime gift tax exemptions. This type of Preferred Partnership is intentionally structured to trigger a deemed gift under Section 2701. Unlike typical freeze partnerships, which are carefully structured to comply with Section 2701 to avoid a deemed gift, an Intentionally Defective Freeze Partnership is set up to violate the rules of Section 2701. This is typically achieved by not structuring the preferred interest as a Qualified Payment Right. For example, the preferred interest might provide for noncumulative preferred payments or include a put right equal to the liquidation preference. While this results in a larger initial taxable gift, it can effectively shift future appreciation to the younger generation while providing ongoing cash flow to senior family members. However, recent proposed regulations addressing "anti-clawback" provisions may impact this strategy's viability. Treasury issued Proposed Regulations in 2022, which aimed to prevent people from artificially triggering a taxable gift to absorb their lifetime gift tax exemption without actually removing assets from their estate.

This Toplitzky&Co publication provides information and comments on tax issues and developments of interest to our clients and friends. The foregoing is not a comprehensive treatment of the subject matter covered and is not intended to provide tax advice. Readers should seek specific tax advice before taking any action with respect to the matters discussed herein.

Securities based line of credit